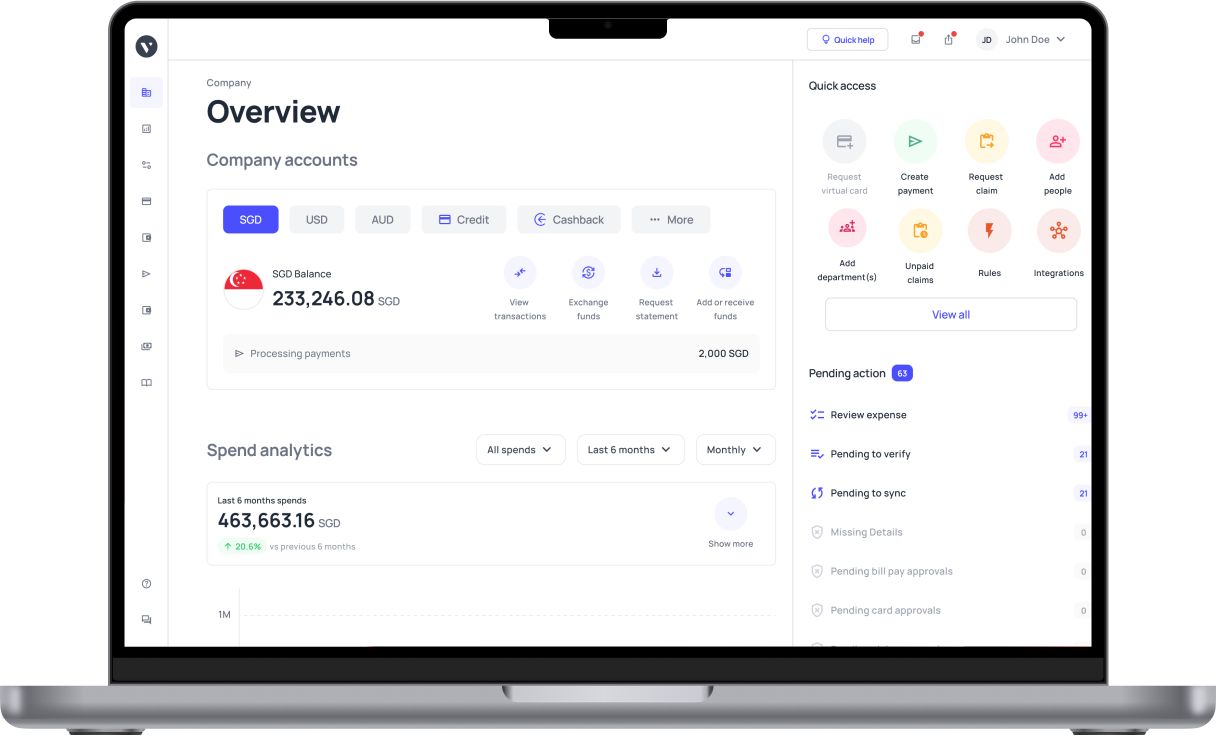

Overview

Welcome to Volopay! As you join us, prepare to revolutionize your business's financial operations with our suite of advanced and streamlined features. Let's explore the tools that will redefine your approach to financial management.

Corporate cards

Volopay offers both physical and virtual Corporate Cards, providing streamlined solutions for business transactions and online payments. These cards feature customizable spending limits and advanced security options. Alongside, the Card Expenses feature provides real-time tracking of all card-related transactions, empowering admins, individual members, and department managers with precise expense management and oversight.

Bill Pay

Volopay's Bill Pay simplifies vendor and invoice management with a unified platform. Automating bill payment processes, including scheduling and approvals, it integrates with accounting software for seamless operation. This feature bolsters vendor relationships with timely payments, ensuring security and compliance.

Reimbursement

Volopay's Reimbursement feature offers a streamlined way to handle claims and expenses. Users can easily manage out-of-pocket expenses and travel reimbursements, with a system that supports expense logging, approval processes, and customizable policies for varied organizational needs.

Payroll

Volopay's Payroll module enables direct processing of employee salaries on the platform, with controlled admin access for confidentiality. It eases beneficiary setup and payment initiation, featuring employee profile creation, independent payroll settings, and a dedicated wallet for clear fund management.

Accounting

Volopay's Accounting feature integrates seamlessly with a variety of major accounting software including Xero, QuickBooks, MYOB, NetSuite, Deskera, and more. It includes a comprehensive general ledger and transaction tracking system that records all company transactions on the platform. Automated transaction classification through smart triggers and real-time syncing streamline the accounting process. Centralized data storage enhances both security and data accessibility, accelerating the book closing process and improving overall financial management efficiency.

Need More Information? Talk to Our Sales Team!

If you have any further questions or need personalized assistance, our sales team is here to help. Please drop us a message, and we will connect you with them.